1 Start off by registering. EA FORM was created by chew yeat.

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Borang ini wajib diberikan kepada setiap pekerja oleh itu kepada para majikan jangan lupa sediakan dan bekalkan borang tersebut.

. Hi there have some problems in the EA form. Since theres no date on Form F the architects. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

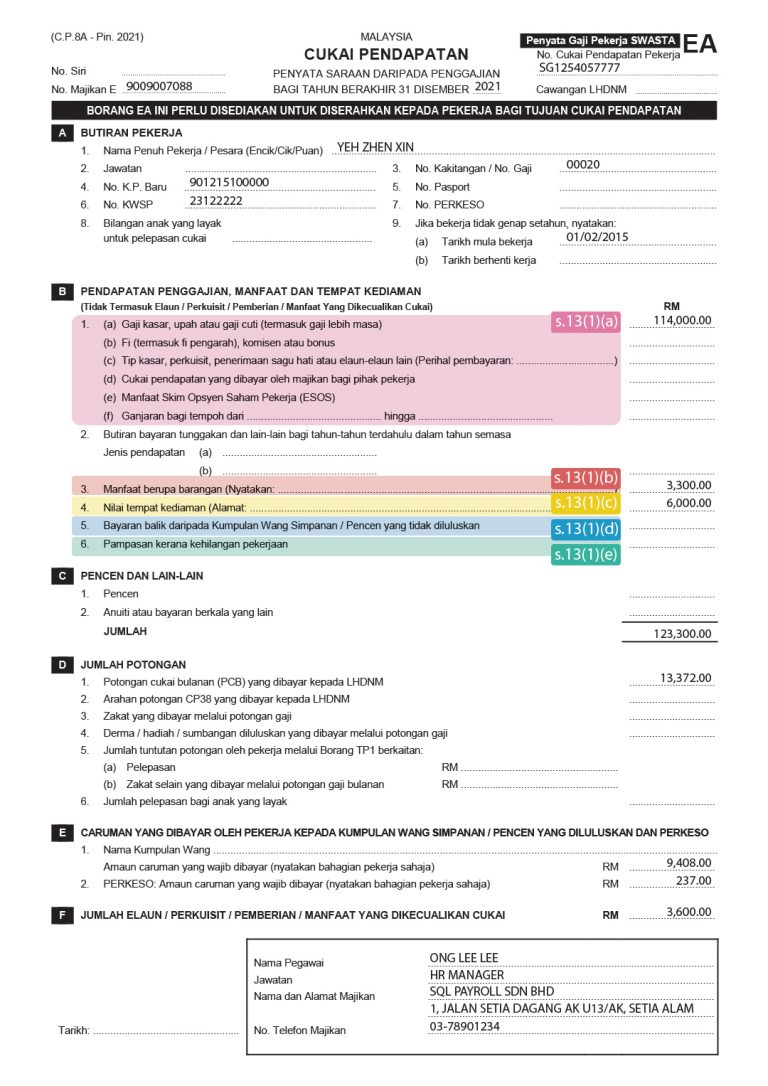

Name Of Employee Income Tax CIdentification Passport No. Borang EA adalah penyata gaji saraan setahun bagi pekerja-pekerja swasta. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

F Tax Borne By Employer Enter 1 or 2 1 Yes 2 No Qualifying Child Relief RM RM No. Section F Section F of the EA or EC Form displays arrears ofprevious years paid in the current year. In section D no 4 a Jumlah tuntutan potongan oleh pekerja melalui Borang TP1 berkaitanPelepasan should key in the SOSCO.

Panduan Pengguna e-Borang ezHASiL versi 32 Panduan Pengguna e-Borang ezHASiL versi 32 12 vii. A Gross salary wages or leave pay including overtime pay b Fees including director fees commission or bonus c Gross tips perquisites awardsrewards or other allowances Details of payment dIncome Tax borne by the Employer in respect of his Employee 3. Seterusnya anda perlu mengisi jumlah pendapatan anda dalam Bahagian B.

Pendaftaran Majikan Pekerja. After you reconfirm your information youll get an application number. Cara isi e-Filing LHDN untuk 20202021 Panduan Lengkap Panduan lengkap cara isi borang eFiling e-Filing LHDN langkah demi langkah.

Benefits in kind 1. Others allowances perquisites gifts benefits which are exempted from tax but not required to be declaredin Part F of Form EA are as follows. 65392 employers were fined andor imprisoned for not submitting Borang E in the Year of Assessment 2014.

Lets go to each of them shall we. You can put that automotive. A Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020.

If this is your first time taking this income tax thing seriously youll need to register first. As a starting point every individual is given a RM9000 default relief. Since there are only two lines in Section F.

Its important to understand the various benefits-in-kind as well as perquisites and. Joseph February 28 2021. How to start.

Dan anda perlukan sedikit rujukan agar proses tersebut berjalan lancar. Lain-lain elaun perkuisit pemberian manfaat yang dikecualikan cukai tetapi tidak perlu dilaporkandalam bahagian f borang ea adalah seperti berikut. Ategory Of Employee 1 Total Gross Remuneration 2 Total Relief TOTAL Nam Note3 Amount of zakatOTHER THAN that paid via monthly salary deduction e CP8D-Pin.

Cukai Pendapatan Pekerja No. Bahagian B9 Jumlah Pelepasan cuma akan diperolehi selepas anda mengisi bahagian ketiga Borang BE di bawah Bahagian F. Go to the official registration page and click on Borang Pendapatan Online.

Certification for the completion of stage 3 Schedule G can only be issued AFTER Form F has been issued same principle for submission of Form E. Butang Simpan Cetak Pengesahan - Untuk menyimpan dan mencetak slip pengesahan penerimaan borang. A pendapatan kasar berkenaan dengan penggajian termasuklah amaun wang yang boleh diterima bukan sahaja bagi tempoh selama penggajian itu dijalankan di malaysia tetapi juga bagi mana-mana tempoh cuti yang bersabit dengan penggajian itu di malaysia dan bagi mana- mana tempoh selama pekerja itu menyelenggarakan di luar malaysia.

Certificate of Completion and Compliance CCC replaces the Certificate for Fitness of Occupation CFO for a single detached building. BORANG EA INI PERLU DISEDIAKAN UNTUK DISERAHKAN KEPADA PEKERJA BAGI TUJUAN CUKAI PENDAPATANNYA JUMLAH ELAUN PERKUISIT PEMBERIAN MANFAAT YANG DIKECUALIKAN CUKAI Nama Pegawai Fi termasuk fi pengarah komisen atau bonus CP. Log on to httpsezhasilgovmyCI Step 1 Please use your personal income tax e-filing ID to log in.

I barangan yang merupakan produk boleh guna perniagaan majikan yang diberi secara percuma diskaun penuh atau diberi pada harga diskaun sebahagiannya termasuk manfaat disediakan untuk. In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah perenggan 1201b Akta Cukai Pendapatan 1967 ACP 1967.

As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. Dont be part of this statistic for the new year. Senarai Semak Dokumen Permohonan Pendaftaran Majikan Dan Pekerja.

Anda mahu isi borang eFiling secara online di laman web LHDN ezHasil. Keep this number for future reference. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D.

Bahagian tengah Borang BE. These arrears may include bonusfor previous years andor retroactive difference amount of the previousyears. Terdapat 3 butang pada skrin ini iaitu.

In accordance with subsection 83 1A of the Income Tax Act 1967 ITA 1967 the Form CP8A Form EA CP8C must be prepared and rendered to the employees on or before 28 February 2021 to enable them to complete and submit their respective Return Form within the stipulated period. This part equals to deductable expenses and you will be surprise on how much you had previously overpaid to government due to ignorance. No Perkeso No IC but no -.

Ia dipanggil borang EC oleh agensi kerajaan. Key in your NRIC and password 请输入LDHN个人电子报税ID和密码 Step 2 Select e-Borang Step 3 Select e-E and then select year 2021 请选择表格 e-E 选择年份 2021 年 Step 4 key in your company E number Nombor Majikan 请输. I Consumable business products of the employer provided free of charge or at a partly discounted price to the employee his spouse and unmarried children.

Skrin Pengesahan Penerimaan e-BE Bagi Tahun Taksiran XXXX seperti di atas akan dipaparkan. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. Kebanyakan maklumat ini ada dalam Borang EA yang anda perolehi daripada majikan anda.

Fill up the registration form. Part F is the most important part because it determines your taxable amount.

Confluence Mobile Community Wiki

What Is Form Ea Part 2 Defining The Perquisites

How To Step By Step Income Tax E Filing Guide Imoney

Customized Frontal Lace Wig Human Hair Blended Color Etsy In 2021 Straight Blonde Hair Long Hair Styles Remy Human Hair Wigs

Sam Smith Stay With Me Sheet Music Easy Piano In C Major Download Print In 2022 Sheet Music Song Lyrics And Chords Easy Piano

Children Of The Light Truth Greatful Earth

Borang Pengesahan Status Tesis Universiti Teknologi Malaysia 1

What Is Form Ea Part 2 Defining The Perquisites

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Esp32 Datasheet By Espressif Systems Digi Key Electronics

Milton Management Services Home Facebook

What Is Form Ea Part 2 Defining The Perquisites

Company Super Form Malaysia Malaysia Company Make Business

Company Super Form Malaysia Malaysia Company Make Business